How To Accounts Cost Of Goods Sold (COG) in Profit & Loss (P/L) (Income Statement)

Ok Guys, To continue with the "Accounting Basics", after having discussion on Sales Revenue. Let’s move on towards the second item on the Income Statement, COGS. I think this article is going to be long coz there are several inner branch of the COGS component which needs to be discussed in order to fully understand what COGS is?????

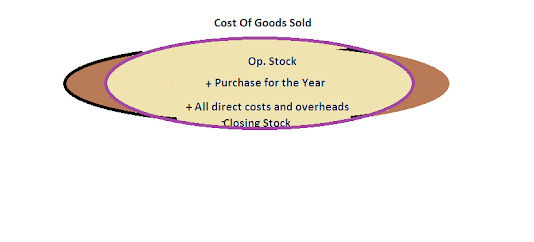

By virtue of its name, COGS is the total cost of goods that has been sold for the particular fiscal year. There are usually there components which will constitute the COGS:

1. Opening Inventory (Opening Stock)

2. Purchase for the year

3. Closing Inventory (Closing Stock)

Now, Let’s go into details on how to accounts:

Opening Stock (Opening Inventory):

Opening Stock within

the COGS component refers to the inventory which is at the opening of the

fiscal year and that will be same as the closing inventory of the previous

fiscal year. Suppose, if In Year 2019 the closing month is December 31st,

the remaining stock at the end of the December 31st will be the

opening stock for the year 2020. Usually fiscal year always consists of 12

months i.e. a year, so the opening day of the year will be January 1st

and the Opening Balance of the New Year, that is 2020 , is same as that of the

closing balance of the Previous Year i.e. 2019. It is needed to calculate the COGS, a P/L item and the Closing

Inventory, a balance sheet item.

Purchase for the year:

By virtue of its name,

Purchase in COGS is the total amount of Gross Purchase made for the year less any

sort of purchase return and discount, which then actually becomes the Net

Purchase for the year. Purchase return, is always the return of any purchased

goods to the supplier because of different reasons and the discount on purchase

refers to the discount that has been received because of various reason like

bulk purchase.

Another thing to consider is the freight and transportation charge

pertaining to the purchases of the raw material. It is the general principle in

accounting that the freight charge and the transportation charge is to be

included within the purchase cost itself. It is within the general principle of

the accounting that the raw material is valued

It is needed to calculate the COGS, a P/L item and the Closing

Inventory, a balance sheet item.

Closing stock (Closing Inventory):

This refers to the

total remaining inventory at the end of any fiscal year. This requires the

actual count of the inventory level and can be time consuming exercise in

various organizations where they lack smart inventory control system. This actual remaining inventory for the

year is the ultimate item that goes to the Current Asset section of the Balance

Sheet and is a balance sheet item and is needed to calculate the COGS in Income

Statement.

What Direct labor charges is?

It is the charge of the workforce that is involved in the manufacturing

unit directly in bringing the finished goods (i.e. the product that the company

sells) from the raw material that is purchased. Simply, it is the charge of the

workforce, mostly calculated in hourly basis.

Another important item to understand the COGS in manufacturing

environment is the Direct Overhead Expense and to understand the Direct

Overhead Expenses we need to understand what actually is Overhead Expense???

Please follow through the link to understand what Overhead expense actually is ???

In Short, direct Overheads are overheads which relates to the production process

of the goods like factory rents, electricity charges allocated for the uses of

machines etc.

Actually, there are other headings that can constitute a component of

COGS, it actually varies according to the nature of industry in which the

company operates like, some companies like AUDI AG and BMW AG incorporates

their warranty claims in COGS. Anyway, the basics are described above and if

you are studying particular industry then you can follow along with the company

specific financial statements and get information from “notes to accounts”

section of the annual reports.

This is all to conclude about COGS (accounting basics) on how to accounts.

If you like the article then, please consider subscribing.

0 Comments